-

Banking

BankingComparing Experian and Equifax: A Comprehensive Analysis

Discover the differences between Experian and Equifax, how they collect data, calculate credit scores, and obtain your credit reports.

May 04, 20242536 -

Taxes

TaxesNavigating the Clean Vehicle Tax Credit: Are You Eligible for Savings?

Uncover the ins and outs of the Clean Vehicle Tax Credit to see if you're eligible for potential savings on your next vehicle purchase. Find out if you qualify today!

Mar 19, 20247115 -

Taxes

TaxesA Comprehensive Guide to Energy-Efficient Home Improvement Tax Credits

You must have heard of the energy-efficient home improvement tax credits. In this comprehensive guide, we will learn every essential detail about them.

Mar 18, 20248927 -

Taxes

TaxesHow To Handle An Irs Audit

Need to know how to respond during an IRS audit? This guide will provide all the information and resources necessary to properly handle your audit appointment. Learn how to prepare, what to expect, and tips and tricks on coming out unscathed.

Feb 26, 20244687 -

Taxes

TaxesTax Benefits of the College Savings Iowa 529 Plan

Investors in the College Savings Iowa 529 can benefit from tax-deferred growth, tax-free withdrawals, and a state tax deduction.

Feb 22, 20245434 -

Banking

BankingExploring Personal Loans: Understanding the Maximum Borrowing Limits

The overall limit for a max personal loan amount differs depending on the specific aspects, including creditworthiness, income levels, and lenders' policies. Read more.

Feb 22, 2024805 -

Taxes

TaxesTax deductions guide

Taxes can be a major source of stress and confusion for business owners. Learn the rules and regulations around deductions with this helpful guide, so you can maximize your savings on your next tax return!

Feb 20, 20245831 -

Banking

BankingLargest Banks In The US

If you'd want to handle all of your banking with a single institution, putting your money in one of the larger banks usually means you'll have greater access to in-person services at branches, a vast ATM network, and a broad choice of goods and services.

Feb 07, 20246159 -

Banking

BankingFinancial Flexibility: 7 Top Benefits of the Capital One Platinum Card

A concise overview of the Capital One Platinum Card highlighting its benefits such as no annual fee, credit building, fraud protection, and travel perks.

Feb 03, 20249844 -

Banking

BankingFederal Stafford Loans Demystified: What Every Student Should Know

Dive into the basics of Federal Stafford Loans, a key aspect of student financial aid, in this straightforward, easy-to-understand guide.

Jan 20, 20248921 -

Banking

BankingWhere to Send Your Letter

You do not need to write a letter to cancel your credit card; however, doing so will provide concrete evidence that you requested your account to be canceled. You could even decide to give the company that issued your credit card a call to shut your account first and then send a letter as a follow-up for your records.

Jan 19, 20248538 -

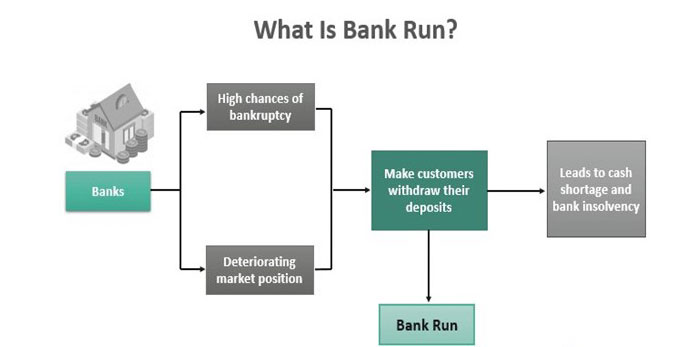

Banking

BankingA Complete Overview of Bank Run

The anxiety of losing their funds drives customers to withdraw all their cash from banks and other financial institutions, leading to a bank run. As a result of the banks' battle to remain afloat and their increased risk of bankruptcy, investors take a closer look at their investments

Jan 15, 20248898 -

Banking

BankingDo You Know About Provident Funds? Functioning and Retirement Benefits

Provident funds are required for retirement savings plans. They resemble 401(k) plans, Social Security, and employer-sponsored pension plans. Read more.

Jan 06, 20242795 -

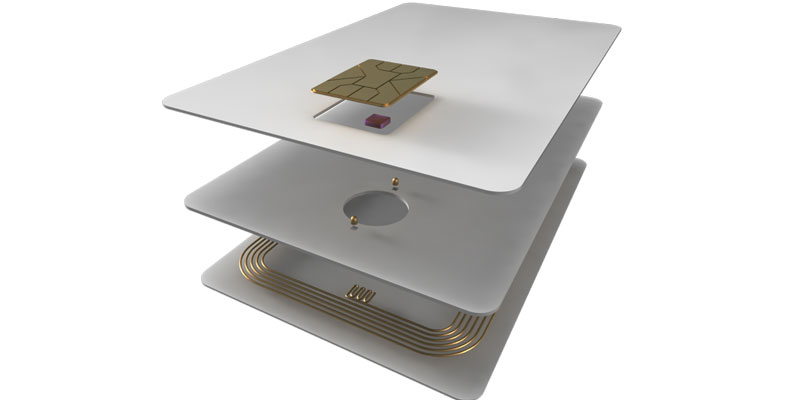

Banking

BankingWhat Is a Dual Interface Chip Card?

In this article, we have discussed how you can be dealt with Social Security Tax Traps and what aspects we should be mindful of to avoid such consequences.

Dec 29, 20235132 -

Taxes

TaxesWhat Are Tax Responsibilities on Money Transferred from Overseas to US

Find out whether you must pay tax on money transferred overseas to the US. Learn more about it in this read.

Dec 23, 20237493 -

Taxes

TaxesA Straightforward Approach to 1031 Like-Kind Exchanges: Tackling Tax Questions

Delve into the realm of 1031 like-kind exchanges with this straightforward guide. Addressing crucial tax questions, this article brings clarity to the intricacies of like-kind exchanges, empowering you to make well-informed decisions for tax-efficient transactions

Dec 17, 20239706 -

Banking

BankingRakuten Cash Back Visa Signature Credit Card Review 2022 in Detail

Online shoppers can save much money with the Rakuten Cash Back Visa(r) Credit Card. Free of charge every year. When used on the Rakuten e-commerce platform, the card provides a generous 3% bonus on all purchases. You can also earn cashback as an alternative to the Membership Rewards program offered by American Express. It's one of the most efficient ways to rack up American Express Membership Rewards if you use a Visa card.

Dec 15, 20232434 -

Banking

BankingThe Top 6 Things to Know Before Freezing Your Credit

Are you someone who wants to freeze their credit but wants to know all the things to consider before carrying out this aspect? This article has you covered

Dec 12, 20239518 -

Banking

BankingMentioning the Best Credit Cards for Large Purchases

Although utilizing a credit card for a loan isn't typically recommended, there are situations in which doing so could benefit you, such as when making a sizable purchase. Choosing the correct card for your spending habits is essential. Credit cards with introductory 0% APR offer, generous sign-up bonuses, and ongoing cash-back incentives are all solid options.

Oct 24, 20233763 -

Taxes

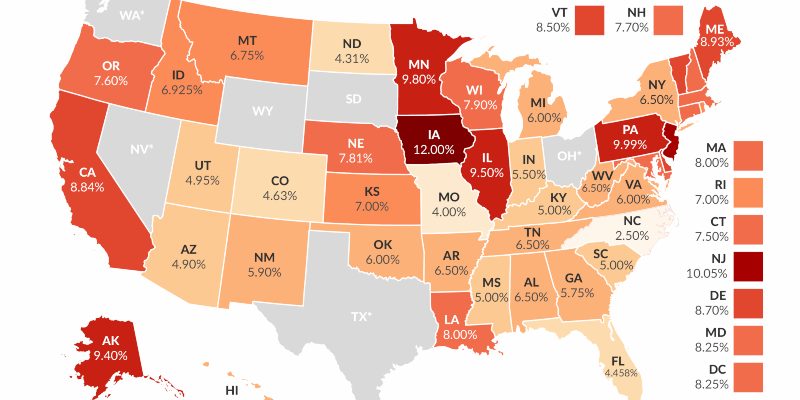

TaxesWhere To Find The Best And Worst Tax Rates For Businesses By State

The Heritage Foundation found that a few of the ten largest tax states have little in common except in the top 10. South Dakota, Nevada (which only taxes gross revenues), and Wyoming have no individual or business income tax. No one in Alaska pays state income tax, and Floridians don't, either. Sales tax is not collected in the states of Oregon, New Hampshire, and Montana. However, this does not exclude a state from placing among the top 10 even while imposing all of the direct taxes. For instance, states like Indiana and Utah impose all of the leading tax kinds yet do so at very modest rates overall.

Oct 19, 20234934 -

Taxes

TaxesSchedule A: Itemized Deductions

Tax Form Schedule A is used by taxpayers who prefer to deduct their expenses in an itemized manner instead of taking an ordinary deduction. The tax law changed in 2017 because the Tax Cuts and Jobs Act (TCJA) removed several deductions, nearly tripling the standard deduction amount

Oct 10, 20238532

-

FinTech

FinTechOver 50% of Americans Prefer Digital Wallets Over Traditional Payments

Sep 06, 2024 -

FinTech

FinTechSpend Management: Key Benefits and Importance for Business Success

Sep 04, 2024 -

Business

BusinessOhio Payroll Guide: Employer's Step-by-Step Process for 2024

Sep 02, 2024 -

Banking

BankingThe Ultimate Guide to Closing Costs: Know Before You Buy

May 19, 2024 -

Taxes

TaxesEverything You Need to Know About Debit and its Relationship to Credit

May 19, 2024