Small businesses that are credit-invisible, have big problems when trying to access funding. Such businesses many times work without traditional credit scores and cannot show their ability to repay loans to the lenders. Because of this situation, these companies fail to get key financial support which restricts their expansion and working processes. But, giving data is appearing as a fresh answer to close this difference. Using not usual sources of data, companies can create different credit profiles and it offers new chances for progress. This article will look at how giving data assists businesses without scored credits that are invisible and the main part it has in scoring alternative credits.

Understanding the Credit Invisible Problem

The phrase "credit invisible" is used for businesses that do not have enough credit history to create a regular credit score. These companies usually work in fields where cash transactions are more common or they are recently set up, so they haven't gathered adequate credit information. In the U.S. and numerous other markets, having good credit scores is crucial for obtaining loans, lines of credit, or investment possibilities. When small companies don't possess these scores, financial institutions put them in the high-risk category. This action effectively prevents them from obtaining monetary assistance.

This large issue can hinder the growth of small companies, especially those in unattended or specialized sectors. With financial systems becoming more dependent on data, there is increasing demand for different methods of credit evaluation that are not solely based on classic credit scores. Providing data appears as a hopeful answer by letting businesses create other forms of credit profiles using non-standard data points.

- Timely Reporting: Ensure that the data provided is up-to-date for accurate credit evaluations.

- Credit Limitations: Many businesses remain unaware of alternative credit scoring options.

The Role of Alternative Credit Scoring

Alternative credit scoring is about ways to judge the ability of a person or business to handle their obligations without depending on usual financial records like bank transactions or loan histories. Rather, alternative scoring uses more extensive data including payments for utilities, transaction histories, relationships with suppliers, and even activities on social media. For small businesses that do not have a well-established credit history, this information can serve as important signs of how capable they are in fulfilling their financial responsibilities.

By contributing data, businesses unseen in credit can start offering this unconventional data to form a more comprehensive credit profile. This broadened evaluation of credit aids in decreasing dependence on traditional scores and gives small enterprises more chances to get finance. By incorporating a variety of info that lenders utilize for evaluating risk, the alternative method of scoring credit provides an all-encompassing system for businesses that would otherwise be sidelined.

- Supplementary Data: Supplier and operational histories can improve credibility.

- Inclusivity: Alternative credit models address biases in traditional systems.

How Data Contribution Works

Supplying data lets companies voluntarily give different sources of information to credit agencies or financial groups. This could embrace details such as payment records with providers, rent payments, utility bills, and other evidence of regular fiscal activities. Some organizations might also offer operational facts like inventory rotation or revenue patterns to show consistency and reliability.

Usually, companies willingly provide their data to third-party platforms proficient in alternative credit scoring. These platforms examine the data and create a report that lenders can employ for evaluating creditworthiness. Instead of depending predominantly on loan repayment history such as traditional credit scores do, alternative credit reports concentrate on daily operational details. This offers lenders a broader understanding of the financial well-being of the business.

For small businesses that lack credit history, this way of adding non-traditional data is crucial to making a breakthrough in financial markets. When the quantity of data increases, so does the business's trustworthiness from lenders' perspective, leading to increased availability of loans, credit lines, and other forms of finance.

- Data Voluntarism: Businesses choose to share relevant financial data.

- Holistic Evaluation: Non-traditional data provides a fuller picture of creditworthiness.

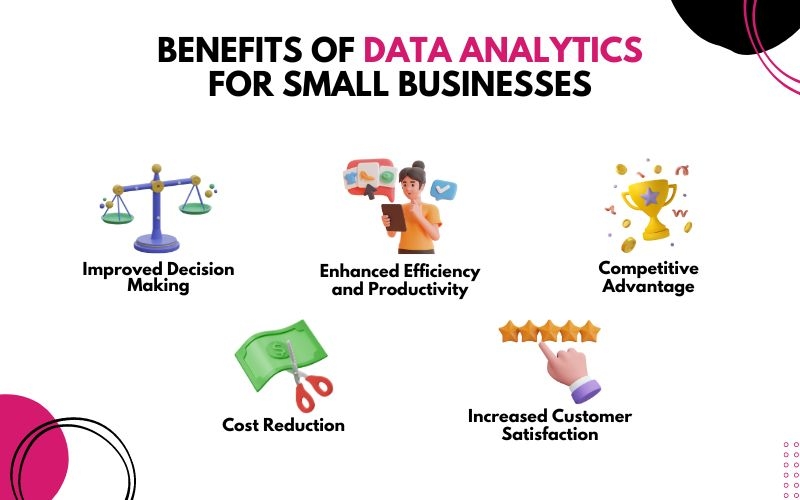

The Benefits of Data Contribution for Small Businesses

Contribution of data provides important benefits for small businesses without credit visibility. First and most importantly, it offers a way to access credit and funding which is vital for increasing business operations, investing in new technology, or expanding market presence. Many small businesses find it difficult to secure even the simplest forms of financial help due to a lack of traditional credit scores. By giving data and creating a different credit profile, they can show lenders a more trustworthy financial image.

Moreover, contributing data can enhance the connections with suppliers and partners. For instance, when on-time payments to suppliers are shared as data, it upgrades a company's reputation as a dependable partner. Not only does this help in obtaining superior terms with suppliers but also raises the credibility of the business across its sector.

Furthermore, through the contribution of data, alternative credit scoring can encourage financial inclusivity. Many small businesses in underprivileged communities or sectors often come across difficulties in getting credit due to systemic prejudice in established credit scoring systems. When these businesses provide non-conventional data, it allows lenders to obtain a more detailed comprehension of their monetary habits and minimizes the effect of such prejudices.

- Supplier Reliability: Positive supplier interactions enhance credit scores.

- Financial Inclusion: Data contribution helps reduce traditional credit barriers.

Challenges and Considerations

Data contribution carries great advantages, but one must also note its challenges. The problem of data accuracy and security is a key issue to observe. Small businesses should confirm that the information they offer is accurate and current so as not to result in possible inconsistencies in their credit reports. Furthermore, companies must take into account data safety as there are specific risks involved when financial and operational information is shared with external platforms. It's vital to collaborate with trustworthy platforms that focus on security and privacy in managing data.

A further difficulty is in the standardization of different credit scoring. Traditional credit scores have set methods, but various platforms and lenders differ when it comes to alternative credit evaluations. This absence of regularity can lead to confusion and inconsistency in evaluating small businesses that are invisible in terms of credit. When more people start to contribute data, it becomes necessary for the industry to make standard practices. This makes sure all businesses are evaluated equally everywhere.

- Data Accuracy: Regular updates to shared data are essential for creditworthiness.

- Standardization Issues: Lack of uniform scoring methods can confuse businesses.

The Future of Data Contribution and Credit Access

As more little businesses start to give data, the financial scenery will keep changing. The increase in alternative credit scoring is now changing how lenders evaluate hazards and allocate credit. For small businesses that lack a clear credit history, this means a big change in their way of dealing with money establishments. When these companies accept data contributions, they can create better credit profiles. This will help them get new chances for financing and in the end, expand their business further.

Over time, small businesses could start to regularly contribute data to set up credit. Already, banks and other money lenders have begun to see how useful different types of credit information can be. As these techniques are combined more fully into the system, it will become easier for unseen small businesses to get credit. This is how providing such data is starting a path towards an equally accessible environment where all small companies can receive loans or credits easily.

- Integration Benefits: Increased collaboration between businesses and lenders enhances credit options.

- Evolving Landscape: Continuous changes in credit evaluation methods will shape future financing opportunities.

Conclusion

Giving data offers a possible course for small businesses with no credit history to create alternative financial profiles and get the funds they require to expand. By providing unconventional information such as payment records, operation details, and utility invoices, enterprises can show their fiscal dependability and widen their chances of getting credit. Even though issues like protection of data and standardization persist, the prospect of giving data possesses substantial promise in changing the landscape of credit management, promoting inclusion, also enabling unassessed firms to prosper.