Many clients withdraw their money from a financial institution immediately because they are worried about the bank's stability, which causes a bank run. The chance of default rises as more individuals withdraw their monies, resulting in a greater number of persons withdrawing their deposits. This may happen in severe instances if the bank's reserves are insufficient.

Bank Runs: An In-Depth Analysis

When a significant number of individuals begin withdrawing money from banks out of concern that the institutions may run out of funds, a bank run occurs. Panic, not actual bankruptcy, usually triggers a bank run. A self-fulfilling prophecy is a bank run prompted by anxiety that causes a bank to become insolvent. Individuals' continued withdrawals of cash put the bank in danger of going into default. It's possible to get into a position when fear turns into a full-blown default.

Why? Because banks don't usually have so much cash on hand. It's very uncommon for financial organizations to have a daily storage limit on the amount they may keep in their vaults. These restrictions have been put in place for the sake of efficiency and safety. Additionally, the Fed Reserve regulates the amount of cash an institution may keep on hand. This cash is utilized to lend out money or spend on other investment products.

In order to fulfill the withdrawal requests of their clients, banks normally hold just a tiny fraction of deposits in cash. Selling assets is one way a bank might grow its cash on hand, often at reduced costs than if it didn't have to sell so rapidly. When assets are sold for less than they are worth, a bank may go bankrupt. There is a bank panic when many banks are under attack at once.

The History of Bank Runs

Banks have been forced to shut down several times throughout history because of customer distrust.

Great Depression

The Great Depression began in October 1929, when the stock exchange in the United States collapsed owing to bank & investor complacency. There were no restrictions on bank loans after the best economic boom of the 1920s. Even people with low credit ratings might get a loan from them. The global economy was booming, so the general population was able to borrow cash from financial institutions and invest freely in the stock market.

Job losses were also a consequence of a decline in industrial productivity. Customer investment and expenditure fell as a consequence of depositors taking their money out of the banks and holding it in cash. All of this caused banks and also the public at large to become nervous. Eventually, banks were forced to liquidate debts and sell assets in order to meet the growing demand for cash withdrawals.

Overproduction in the Farming Sector

The financial market in the United States slowed and fell as a result of this circumstance. Global economic output dropped as a consequence, leaving the United States reeling. As a consequence of the 1929 bank run, the people started withdrawing their money.

Insurance Deposits

Following these events, FDIC was established in 1933. Deposit insurance served as a means of monitoring, controlling, and safeguarding the public's funds. This helped commercial banks cope with the cash crunch while keeping public confidence in the financial system. After Great Depression in 1929, the deposit insurance program helped people rebuild their faith in financial institutions. In the case of a bank collapse, the FDIC ensured that customers' actual money was repaid by moving their savings deposits to another bank or by auctioning the bank's assets.

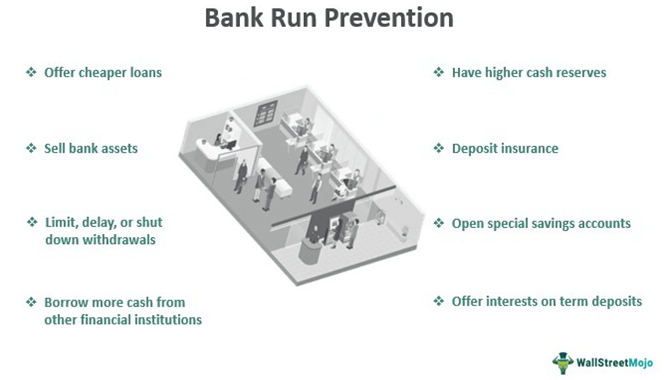

Preventing Bank Runs

Several measures were taken by governments in the 1930s to reduce the possibility of potential bank runs. As a result of this, banks were required to retain a specific proportion of their total deposits in cash. Also, in 1933, the United States Congress formed the FDIC. This institution was formed in reaction to the various banking crises that occurred in the prior years. The Federal Reserve's primary goal is to ensure financial stability and public trust in the United States economy. However, when confronted with the possibility of a bank run, banks may need to be more vigilant. They could do it this way.

1. Slow down the pace.

If a bank run is imminent, banks may opt to close for a period of time. That way, no one can just stand in line and withdraw their cash. After Franklin D. Roosevelt became president in 1933, he implemented this policy. A bank holiday was proclaimed, and inspections were ordered in order to make sure the banks could operate as usual.

2. Borrow.

Lacking sufficient liquidity, banks might turn to other financial institutions for a loan. They may be able to avoid bankruptcy by taking out large loans.

3. Insure deposits.

People's anxiety about losing their savings lessens when they learn that they are protected by the federal government. It's been like this since the FDIC was created in the United States.

Concluding Words

When false reports propagated across media platforms and messaging applications claiming UK-based Metro Bank was seeking to seize customers' goods and money stored in secure deposit boxes, the latest alleged bank run happened in May of 2019. In the wake of this, Metro Bank clients started clamoring for cash. Several regulatory safeguards have been put in place to reduce the risk of a bank run, but electronic transactions may still be used to facilitate a quiet bank run. Be ready now!