Provident funds are mandatory retirement savings programs in several developing nations like Singapore and India. They're similar to a blend of the U.S.'s 401(k) plans and Social Security, with elements similar to employer-sponsored pension plans. In these schemes, employees earmark a part of their earnings for the provident fund, a contribution matched by their employers. The government oversees the management of these funds, which are later accessible to retirees. In specific instances, these funds extend financial aid to surviving family members or individuals unable to work due to disabilities.

Despite the growth of private savings in numerous developing countries, these savings alone often fall short of guaranteeing a comfortable retirement. The evolving social landscape exacerbates this shortfall. The transition from rural to urban settings, the swift pace of industrialization, and the transformation of family dynamics are redefining societal structures, particularly impacting retirement planning.

Traditionally, it was the extended family that looked after old folk. Nevertheless, birth rates are down; people live farther apart and longer in life. Therefore, this practice is hard to maintain. Governments in many developing countries have initiated provident funds to address these challenges. These funds are a scalable solution to stabilize retirees and other at-risk groups financially. They leverage contributions from both employers and employees to build a sustainable financial reservoir for the future.

Contributions and Withdrawals in Provident Funds

Different provident funds around the world have their distinct rules regarding contributions. Workers and employers are usually required to meet certain minimum and, at times, maximum contribution limits. Interestingly, these minimums might change based on an employee's age, and there's often room for both parties to contribute more than the baseline requirement, enhancing future benefits.

Regarding accessing these funds, each government defines an age threshold for penalty-free withdrawals. However, exceptions exist for early withdrawals under specific conditions like health crises. A unique case is seen in South Africa, where individuals who haven't resided in the country for three years can claim their provident fund payouts regardless of age.

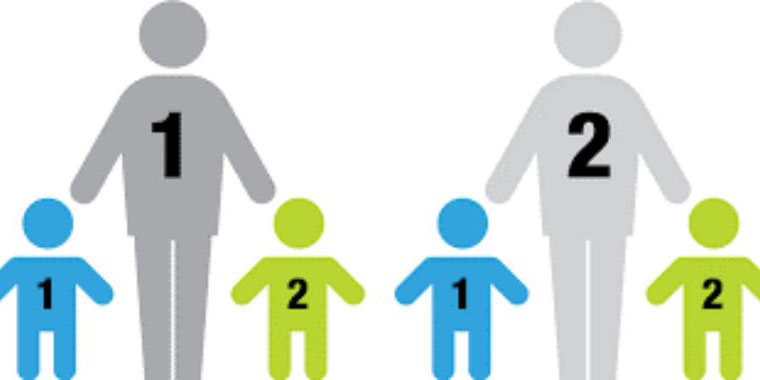

In various nations, individuals working beyond the typical retirement age might encounter limitations on fund access until they reach the designated full retirement age. Should a fund contributor pass away before benefiting from the provident fund, their immediate family, such as a spouse or children, may be eligible for survivor benefits.

Advantages of Investing in a Provident Fund

Ensuring Financial Independence in Retirement

A key advantage of a provident fund is the financial independence it secures for one’s later years. The steady contributions over an individual's career grow and compound, eventually summing up to a considerable amount at retirement. This fund becomes a dependable income stream, easing the burden on family or government support systems.

Tax Relief and Incentives

Many jurisdictions provide tax benefits linked to provident fund contributions. These might include income tax deductions for the contributed amount or the fund's growth being tax-exempt. Such features position the provident fund not just as a retirement planning tool but also as a smart strategy for tax management.

Additional Perks of Provident Funds

Provident funds may have other benefits tailored to each country's regulations besides aiding in retirement savings and offering tax advantages. These could encompass options like borrowing against the fund for housing or education, insurance benefits, or family support in case of the contributor’s untimely death.

Some funds also extend disability benefits, offering a financial safety net to members who cannot work due to disability.

Challenges of Provident Funds

Vulnerability to Market Dynamics

While Provident Funds accounts are celebrated for their benefits, they have limitations. A primary concern is their susceptibility to market risks. Since these funds often invest contributions in various financial markets, market fluctuations directly influence their performance.

In economic prosperity, these investments can flourish, enhancing retirement savings. However, investment returns may diminish during economic downturns, negatively impacting the fund's growth. This uncertainty in market conditions could destabilize the financial security that Provident Funds aim to provide.

The Issue of Inflation and Diminishing Value

Inflation poses another significant challenge. As the cost of living rises, the purchasing power of the money saved in Provident Funds can erode over time. This erosion is particularly problematic in regions with high inflation, where the real value of the savings diminishes more rapidly than expected. This problem is exacerbated in areas with high living costs or when the contribution rates to the Provident Fund don't align with inflation rates, leading to a potential shortfall in post-retirement funds.

Insufficiency of Funds for Retirement Needs

Lastly, there's the concern that the Provident Fund might not accumulate enough to support a retiree's expenses. Despite being designed for financial security in retirement, the reality often differs due to increasing healthcare costs, extended life expectancies, and rising day-to-day expenses.

This issue is more pronounced when contribution rates are low, or individuals have had inconsistent contribution histories. Therefore, one may find his or her accumulated savings falling short of the cost of a good retirement. Diversified planning for your future and considering all possible sources of income after you retire are undoubtedly sounder plans than putting blind faith in government pensions alone.

A Global Overview of Provident Fund Systems

Singapore's CPF

Singapore's Central Provident Fund underpins a social security system for retirement, housing, and healthcare. Employees and employers contribute to the CPF at different income and age levels. The Ordinary Account covers housing, insurance, and investment; the Special Account covers pensions and investments; and Medisave covers hospitalization and medical insurance.

Indian Employee Provident Fund

The Indian EPF is a vital retirement benefit for salaried workers. EPFO runs it. The employee and employer both pay 12% of the servant's base wage and dearness allowance. This interest is what funds the fund. Under certain conditions, such as retirement, home purchase, or critical illness, these funds are accessible to employees.

Provident Funds in Other Developing Nations

In many developing countries, public provident funds are important in providing a financial future for their working population. Malaysia, for instance, has the Employees Provident Fund (EPF), which offers retirement benefits and saves money like Singapore's CPF. Similarly, countries like Kenya and Ghana have implemented their own Provident Fund schemes to create a financial safety net for their elderly citizens. These funds play a vital role in these economies, helping to assure a more secure financial future for their workforce.