Managing US tax implications of international money transfers is complicated. The tax implications of receiving foreign funds in the US depend on the transaction. Should you sell international real estate and earn a profit, you will be liable for capital gains taxes in the US. You do not pay tax on a monetary gift from a foreigner. However, sending funds to the US from abroad may attract various tax penalties.

Taxes on Foreign-to-US Fund Transfers

Transferring money from abroad to the US requires checking for tax liabilities. This affects whether you are an expatriate sending money home or a US citizen receiving international money transfers.

The sender's identity and the amount transferred determine tax liability. Our American expatriate taxation-savvy CPAs can help you determine capital gains, gifts, inheritances, and foreign funds transferring money from overseas to USA tax obligations.

Overseas Property Sales

You must understand the US tax rules that apply when you get paid from the US after selling a foreign property. Transferring money overseas to the U.K. is considered a capital-gaining tax. Our tax consultants will guide you on your tax liabilities depending on your long-term or short-term benefits. This is where the time you held the foreign property before its sale comes in.

Americans' most common activities are transferrals of funds overseas after land deals. Selling foreign real estate may put an investor in this situation. This also applies if you lived abroad and sold your home after returning to the US. In either situation, you will be liable for capital gains transferring money from overseas to USA tax with the sale proceeds transferred into your American account. Your gains can be short-term or long-term and have different tax rates depending on your tax bracket.

Transferring money overseas and the subsequent tax implications require careful handling. Our team of accountants is adept at guiding you through these intricacies, ensuring you comply with the tax regulations while optimizing your tax obligations. Understanding the nuances of transfer money overseas and its tax impact is vital for anyone dealing with international property sales.

Our approach focuses on providing clear, straightforward advice. We avoid complex jargon, making understanding transfer money overseas tax requirements as simple as possible. Whether you're dealing with long-term or short-term capital gains, we are here to assist in assessing your situation accurately and advising on the best course of action.

International Financial Gifts

Nevertheless, I suggest receiving a gift from a different country as an American. In most cases, no taxes are required on the money that foreigners give you. However, there's a catch. Since it is an international overseas money transfer, you may have to declare it to the US government. Our tax accountants come in here. They can show you the way, helping you fill in IRS Form 3520, which must be done correctly.

On the other hand, if you're an American expat sending money to someone in the U.S., different rules apply. Transferring money from overseas to the USA might attract taxes if your gift is over $16,000. This figure is the current year's limit for tax-free gifts.

If your gift exceeds this amount, it's not as straightforward. You'll need to report this overseas money transfer. Don't worry; our skilled tax CPAs are here to help. They'll efficiently handle IRS Form 709 for you and make sure it's submitted by transferring money from overseas to USA Tax Day.

Bear in mind that when sending money abroad, whether as a transferee or a transferrer, it’s necessary to be knowledgeable and observant of tax laws. Moving funds is not simply moving them; it must be legally aligned.

Inheriting from Abroad

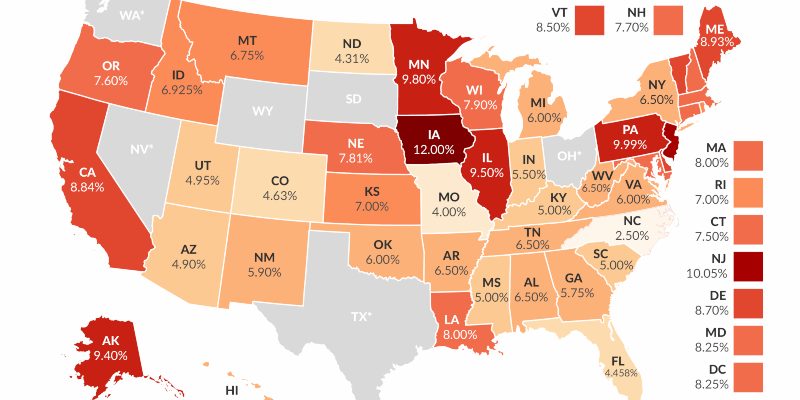

It is usually good news when you are an American citizen and inherit from a foreign relative. Nevertheless, you must understand the laws on tax. However, that does not imply one is entirely relieved in the U.S.; the federal government hardly taxes such inheritances. There are also state taxes for inheritances that foreigners may be subjected to in some states of the US, hence the need to find out what is applicable in the state you live in.

For example, assume you have received property or other assets from a relative who had property in the US but lived abroad. You will likely have to pay transferring money from overseas to USA tax assets included in the inheritance. In many instances, the situation occurs during the last minute of a retiring American expatriate who has stayed abroad and left some assets in the country.

And if you inherit something more than 100,000 US dollars from a foreign person, you have one more obligation – report that to the IRS. To perform this task, you’ll have to complete Form 3520. This is a mandatory step to ensure compliance with U.S. tax guidelines, and failure to do so can create problems later.

Transferring Personal Funds

An expatriate’s life entails a lot of comings and goings – not only in travel but also in finances. If you are returning from overseas, one thing to consider is transferring money from a foreign bank to a bank in the United States.

Here’s some good news: since this money won’t be new income, it simply reflects your funds’ location movement, and as such, such transfers won’t be taxed. Nevertheless, this is not an easy process because of regulations that seek to curb criminal financial activities.

For instance, if at any point you had more than $10,000 in your foreign accounts and didn’t report this using FinCEN Form 114, transferring this money to a U.S. account could raise questions. Properly writing your foreign financial holdings is crucial to avoid legal issues with FinCEN.

Moreover, if you bring more than $10,000 in cash back to the U.S., you must declare this. The same goes for large sums brought in through money orders or traveler’s checks. You must use U.S. Customs and Border Patrol Form 6059B and FinCEN Form 105. It’s essential to ensure that your transfer money overseas to the USA remains transparent and within legal boundaries, avoiding unnecessary complications with U.S. financial authorities.