The advancement of Financial technology, also known as FinTech, is fast. Because of this development, usual banks are exploring fresh methods to remain competitive. They do this by forming alliances with these creative firms. Banks have found it crucial to work together with FinTech to provide top-level digital services and simplify operations. Furthermore, they need to match the demands of customers who value quickness and ease more than ever before in today's world. This article will look into the rise of such collaborations- their advantages and how they affect what lies ahead for finance business-wise.

The Rise of Bank and FinTech Partnerships

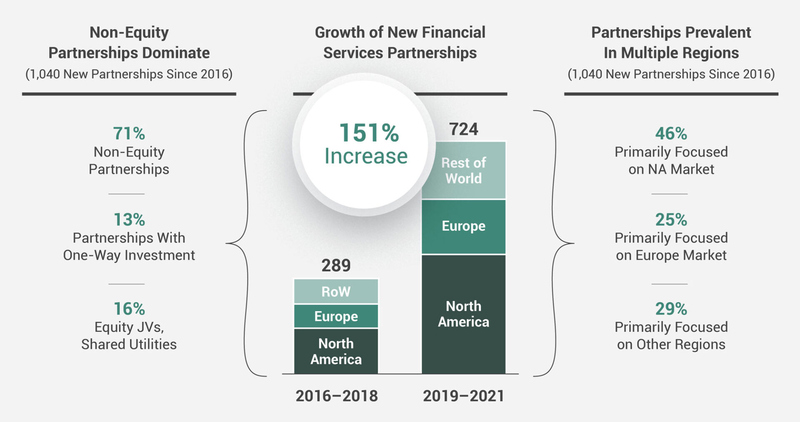

The partnership of banks and FinTech companies has seen noteworthy growth in the past few years. Before, banks used to be cautious about these FinTech firms, seeing them as rivals that could interfere with their business plans. But now this perspective has changed when they understood that teaming up with such tech-based companies can have potential benefits. When banks make partnerships with FinTech firms, they get access to advanced technologies like blockchain, artificial intelligence, and cloud computing. This allows them to become more efficient and better serve their customers.

A major reason for the increase in these collaborations is due to shifting customer expectations. Nowadays, customers desire quicker and more easy-to-use banking solutions that provide adaptability as well as access all day, every day. FinTech firms are very proficient at supplying such services by using mobile applications, digital wallets, and other ground-breaking products. Banks are now more frequently seeking partnerships that let them access FinTech knowledge and provide smooth, easy-to-use digital experiences to maintain pace.

- Note: Compliance with evolving financial regulations remains a priority in partnerships.

- Consider: Joint ventures can further enhance customer trust by focusing on security measures.

Benefits of FinTech Collaboration for Banks

Cooperations between banks and FinTech companies provide many benefits that assist financial establishments to stay competitive in a changing market. A notable advantage is the capability to make operations more efficient. Often, FinTech solutions come with automation and data analysis features enabling banks to cut down expenses and enhance productivity. With the use of these tools, banks can make automatic regular tasks like questions from customers, approval for loans, and processing payments. This allows them more time and resources to concentrate on intricate services.

Another principal benefit is the chance to connect with new client groups. Lots of FinTech firms are experts in serving markets that usually get less attention, like people who don't have access to normal banking services. By collaborating, banks can use FinTech platforms to increase their scope and provide financial services to groups that were earlier hard to reach. This could result in more customers being attracted and faithful, especially among the younger generations who are good with technology.

FinTech cooperation gives banks a helpful method to fulfill regulatory needs. As rules get tighter in finance, banks face stress to keep up with compliance standards. FinTech companies usually create ways that assist financial firms in understanding the difficult regulation surroundings, lowering non-compliance risks and related punishments.

- Tip: Leveraging AI-powered automation tools can greatly reduce processing times.

- Fact: FinTech solutions help banks reduce operational costs by up to 20%.

How FinTech is Shaping the Future of Banking

FinTech's impact on the banking sector reaches much more than just operational enhancements. Innovations in FinTech are leading to basic alterations in how banks deal with their customers and provide financial services. A significant trend that can be observed is moving towards open banking, a model that permits developers from third parties to create applications and services surrounding financial establishments. With open banking, banks can spread the data of their customers (with permission) with FinTech companies. This enables financial products and services that are more tailored to personal needs.

Also, FinTech has an important part in improving financial inclusion. Traditional banking systems many times do not serve certain groups of people well, like those living in rural places or persons with low credit scores. To solve these problems, FinTech companies assist banks by using different data to determine creditworthiness, give small-scale loans, and supply digital payment methods where there's a lack of banking facilities. As a result, financial services are becoming more accessible to a broader audience.

The fusion of artificial intelligence (AI) with banking procedures is a significant trend shaped by partnerships in FinTech. Tools powered by AI, like chatbots and virtual assistants, are rising in use for customer service. This lets banks address questions more swiftly and effectively. Moreover, AI aids in discovering and stopping fraud by inspecting transaction trends and noticing doubtful activity instantly.

- Caution: Open banking requires strict data privacy regulations to protect users.

- Fact: AI-powered tools can reduce fraud detection times by 30%.

The Role of Regulatory Sandboxes in Facilitating Partnerships

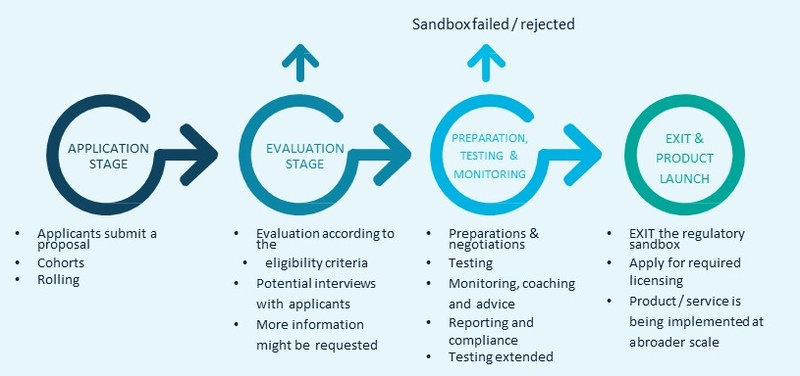

Regulation plays an important part in forming bank partnerships with FinTech companies' layouts. A method that has come up to encourage innovation along with maintaining compliance is the application of regulatory sandboxes. These are controlled settings where financial establishments can experiment with new offerings and services together with FinTech businesses under regulators' watchful eyes.

The start of regulatory sandboxes has greatly influenced both banks and FinTech companies. These set-ups let them try out new technologies without fear of breaking the rules. This method promotes creativity, helping financial organizations gain knowledge about putting into practice these fresh technologies while still meeting rule requirements. Also, it gives regulators a glimpse into the upcoming trends in financial technology which lets them modify rules appropriate for the changing scenario.

Around the globe, more and more countries are taking up regulatory sandboxes to help FinTech collaborations grow. The Financial Conduct Authority (FCA) of the ted Kingdom and the Monetary Authority (MAS) from Singapore have created some famous sandboxes. These places give banks and FinTech enterprises a spot for working together on fresh solutions that can be enlarged internationally or put into practice globally.

- Fact: Regulatory sandboxes reduce the risk of non-compliance while innovating.

- Tip: Banks should seek early engagement with regulators when testing new solutions.

Challenges Facing Bank and FinTech Partnerships

Bank and FinTech collaborations are growing, offering lots of opportunities. However, financial institutions face difficulties too. Mainly dealing with data security is a challenge. Banks work together with FinTech firms and give out sensitive customer details which necessitates making sure this information stays safe as a crucial importance. Both groups must put resources into strong cybersecurity methods. This will lessen the possibilities of possibility and uphold the trust of customers.

Another difficulty is the cultural contrast between conventional banks and FinTech corporations. Banks are usually considered more careful and less risky, whereas FinTech firms appear to be quicker and open to trying out fresh technologies. To bridge this cultural gap, we need free-flowing dialogue and mutual recognition of the targets or objectives for collaboration.

Finally, scalability can be a big challenge. Many FinTech solutions might function well in the pilot stage or inside the regulatory sandbox but expanding these solutions to cater larger customer base may pose difficulty. It is essential for banks that the technologies they take up fit seamlessly into their present systems without causing disturbance to operations.

- Note: Both partners must invest in continuous cybersecurity improvements.

- Consider: Banks should develop long-term integration plans to ensure scalability.

The Future of FinTech and Bank Collaborations

In the future, it seems apparent that collaboration between banks and FinTech businesses will persist in rising and molding the destiny of financial trading. As more people seek digital banking options, conventional banks should depend on FinTech firms to remain competitive while addressing changing consumer needs. It is probable these alliances will incite further progress in tech areas such as AI, blockchain, and unrestricted banking - propelling novelty throughout this sector.

Simultaneously, the regulators hold a key position in making these partnerships possible. It is their job to ensure that creativity and innovation can flourish without destabilizing financial systems. The ongoing creation of regulatory sandboxes along with other supporting structures will play an essential part in allowing banks and FinTech companies to test out innovative concepts and provide advanced services for their clients.

- Consider: Increased collaboration between global regulatory bodies is expected.

- Fact: The global FinTech market is projected to reach $324 billion by 2026.

Conclusion

Finally, when banking facilities make agreements with FinTech firms, it is a strong plan for financial organizations that want to adjust to the fast-changing conditions. By making use of knowledge from Fintech businesses, banks can improve their working process, extend their exposure, and stay first in line in this growing digital world.